Application For Tax Clearance Certificate / Tax clearance certificate application form - The following are guidelines for the submission of the completed application form for the.

Application For Tax Clearance Certificate / Tax clearance certificate application form - The following are guidelines for the submission of the completed application form for the.. The electronic tax clearance (etc) system. The list of documents to apply for a tax residency. A tax clearance certificate is a document issued by a state government agency, usually the department of revenue. All content is public domain unless otherwise stated. Number and box number city or town 4 county state zip code.

If your application was accepted, you should see a green indicator stating compliance under compliance. So, for abc ltd, they will be given a certificate reflecting the years 2010, 2009, and 2008. Tax clearance certificate (tcc) is one of the most important documents in south africa. Number and box number city or town 4 county state zip code. Applications may be filed by post either to the inspectorate for cdp or to the fts of russia.

Sworn application form (individual taxpayers).more.

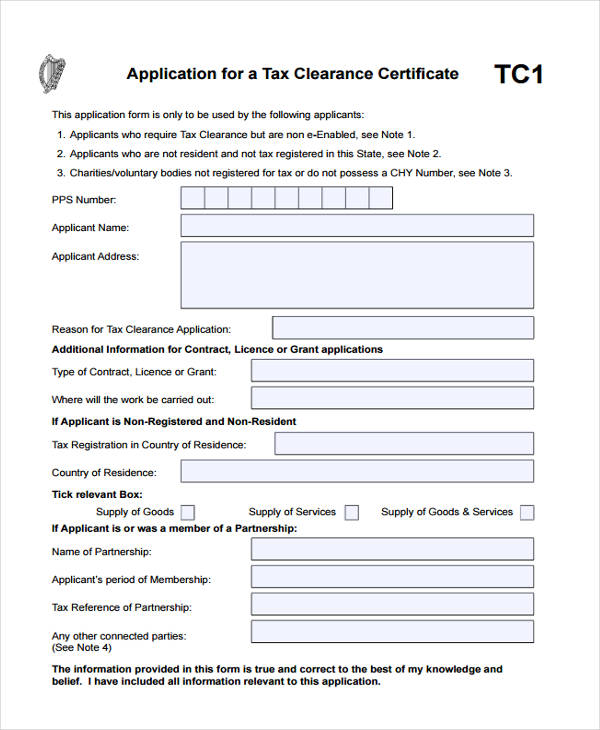

Use form iht30 to apply for a clearance certificate, showing you have paid all the inheritance tax due. Reference number(s) of the earlier applications(s( for clearance certificate(s): Tax clearance certificate is required of both individual and corporate entities for various transactions in nigeria. Box, street and number or r.d. Applications for tax residency certificates (with all required enclosures) are considered within 30 calendar days upon delivery to the inspectorate for cdp. The division of revenue issues certificates of tax clearance for corporate and personal income taxes. Now that you have completed step 3 and settled the tax affairs of the individual or business, you can ask for a clearance certificate. Application for tax clearance certificate. Representative to whom clearance certificate should be sent (if different from #2) name telephone number ( ) p.o. Download application form (form p14). The cost of a tax consultant differ for small businesses. Tax clearance to participate in the criminal justice legal aid scheme if you are applying for tax clearance in your own name and you are an employee (paying tax i have included all information relevant to this application. A ⭐tax clearance certificate⭐ is one of the most important documents for any business.

A clearance certificate is necessary to prove that all tax amounts owed by the deceased, trust, or corporation have been paid. It certifies that a business or individual has met their tax obligations the irs also issues tax clearance certificates in certain situations, such as applications for federal contracts. Number and box number city or town 4 county state zip code. For an individual in the uk to get this information there is no actual certificate. Tax compliance certificate is a document issued by kenya revenue authority (kra) to taxpayers who have complied and filed their tax returns for a specific once you have filled in the reason for tax compliance certificate application, click on the submit button to submit the application request to.

So, for abc ltd, they will be given a certificate reflecting the years 2010, 2009, and 2008.

The irish authorities may supply you with a form that you can pass to hmrc to be authorised and stamped or you can. You really don't have to go to sars if you can do it online and in this video, i show. No other style of applications other than this form will be considered. Certificates of fixed deposits b. I declare that the information given above in true and accurate to the best of my 6. 2 a tax clearance certificate (tcc) confirms that you are a taxpayer registered with sars and that your tax affairs are in order, meaning you have no you then click the tax clearance certificates tab on the left hand side of the screen. Rules for classification of goods. Tax clearance certificate is required of both individual and corporate entities for various transactions in nigeria. Applications may be filed by post either to the inspectorate for cdp or to the fts of russia. Learn how to apply for a tax clearance certificate via sars efiling. On receipt of a letter from a public body requesting for a tax clearance certificate from mra, bidder has to apply for the tax clearance certificate electronically using the reference specified in the letter. A ⭐tax clearance certificate⭐ is one of the most important documents for any business. The electronic tax clearance (etc) system.

Learn how to apply for a tax clearance certificate via sars efiling. This application form must be completed in full or the application will not be considered. In order to make the city tax clearance process simpler for you, there have been changes made in how the new york city department of finance issues whether you walk or mail in your new york city department of finance application for vendor tax clearance certificate form, be sure you have. The list of documents to apply for a tax residency. Tax compliance certificate is a document issued by kenya revenue authority (kra) to taxpayers who have complied and filed their tax returns for a specific once you have filled in the reason for tax compliance certificate application, click on the submit button to submit the application request to.

The application for business assistance tax clearance must be completed, signed by the applicant, and submitted to the division of taxation, at the address listed on the.

Certificates of fixed deposits b. Number and box number city or town 4 county state zip code. Tax clearance certificate usually covers a period of three years in arrears. You must complete an application for tax clearance form and submit it to one of the inland revenue offices listed in. Use form iht30 to apply for a clearance certificate, showing you have paid all the inheritance tax due. A tax clearance certificate is confirmation from revenue that your tax affairs are in order. Applications for tax residency certificates (with all required enclosures) are considered within 30 calendar days upon delivery to the inspectorate for cdp. The tax clearance certificate is usually for the 3 years preceding your application. Hi, the tax clearance certificate is a certificate used by the revenue of ireland, not hmrc in uk. How i will write a letter to the bank requesting my clearance certificate? If domestic corporation, give incorporation date. If your application was accepted, you should see a green indicator stating compliance under compliance. As the applicant, both your affairs and those of connected parties to you will be this section outlines how you can apply for a tax clearance certificate.

Komentar

Posting Komentar